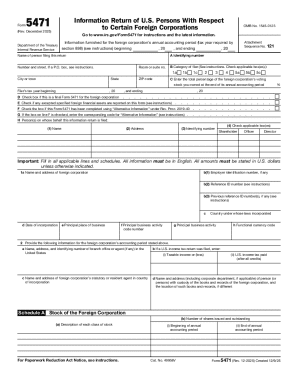

IRS 5471 2018 free printable template

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

About IRS 5 previous version

What is IRS 5471?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 5471

What should I do if I realize I made an error after filing my 2012 form 5471?

If you discover a mistake after submitting your 2012 form 5471, you should file an amended return using Form 1040X for U.S. individuals or the appropriate form for your return type. Ensure you indicate the changes clearly, maintain a copy of the corrected form, and retain records of your amendments for your files.

How can I check the status of my submitted 2012 form 5471?

To verify the status of your submitted 2012 form 5471, you can contact the IRS directly or use their online tools if available. Keep your submission details handy to ensure smooth communication, and be prepared for common e-file rejection codes to track any potential issues.

What technical requirements should I consider for e-filing my 2012 form 5471?

When e-filing your 2012 form 5471, ensure that your software is compatible with IRS requirements and that your browser is updated. Additionally, check any specific technical guidelines provided for mobile devices or secure data practices to protect your personal information during submission.

How should I handle receiving a notice related to my 2012 form 5471?

If you receive a notice regarding your 2012 form 5471, read it carefully to understand the request or issue. Prepare necessary documentation and respond in a timely manner, ensuring you address all points raised to facilitate resolution and maintain compliance.